UK retail bible, Retail Week, this week published an article headlined: Is payment the next big retail differentiator? The author, Hugh Radojev, (who was kind enough to include my comments in the piece), explores the opinions of many experts in the retail and payments space, almost all of which answer the question posed by the headline in the affirmative. And, it seems, ‘buy now, pay later’ payment technology is a key way to differentiate.

Now, as the founder of a company that offers a payment platform that falls into this category, I have to admit to a little bit of bias. Nonetheless, hear me out when I say that retailers that are not offering a payment platform like this could well be missing a trick. And you don’t have to take it from me, or any other retail entrepreneur or expert out there – take it from the customers, over here in the UK and beyond.

As the piece in Retail Week highlights, customers are not just happily using ‘buy now, pay later’ options when they happen upon them at the checkout. They are actively seeking out brands that offer this, and contacting their favourite stores to ask them to implement such a payment platform when one doesn’t exist. As Accenture’s managing director of payments in the UK and Ireland, Sulabh Agarwal, articulately puts it, “customers no longer want to be restricted by traditional payment methods.”

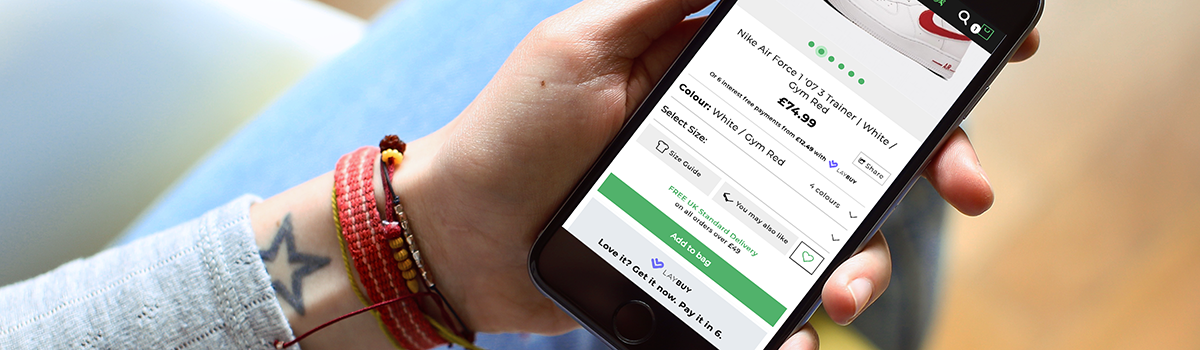

If this isn’t evidence enough, take Australasia as further example of how ‘buy now, pay later’ has the potential to transform retail. Laybuy started life in New Zealand; the merchants that we work with over there have reported new customer acquisitions upwards of 30% using our platform, and that’s not all: More than 8% of the whole voting population of the country are now signed up to use Laybuy as a payment option.

The result of this incredible usage of the platform has seen merchants reporting an average uplift of order values of up to 60% and conversion rate increases of 50%. Not bad, even if I do say so myself.

So it’s not really about just listening to me and others in the ‘buy now, pay later’ game saying, “this is cool, and pretty powerful, why not give it a try and see what happens?” The results we’ve seen merchants achieve with the platform so far speak for themselves – and your customers will sooner or later speak for themselves too by demanding flexible payment options of this type. And the cold truth is that where there’s no flexibility and choice, shoppers are likely to look elsewhere. This I know first-hand from my own retail experience.

There’s a huge opportunity for retailers in the UK and beyond to get ahead of the game by exploring different and flexible payment platforms now. The brand benefits are tangible and undeniable, and sooner or later I can guarantee there will come a stage where implementing payment flexibility ceases to be a choice and becomes a necessity for success.

Get ahead of the curve and ahead of competitors by differentiating your payments functionality now. Give us a shout at Laybuy – you won’t regret it and your customers will love it.

Comment